What You Gain by Outsourcing Your Accounts Payable Process

In today’s fast-paced and cost-sensitive business environment, finance leaders are under constant pressure to improve operational efficiency, reduce overheads, and enhance accuracy. Among the many finance functions ripe for transformation, accounts payable (AP) stands out as one of the most time-consuming, error-prone, and resource-heavy areas. That’s why more businesses — from mid-sized companies to large enterprises — are embracing accounts payable business process outsourcing (AP BPO) as a strategic solution.

Outsourcing AP isn’t just about reducing headcount or moving tasks offshore. It’s about streamlining workflows, leveraging automation, minimizing costly mistakes, and freeing up internal teams to focus on more strategic initiatives. Let’s explore how accounts payable business process outsourcing can save you both time and money, while improving your financial operations.

What Is Accounts Payable Business Process Outsourcing?

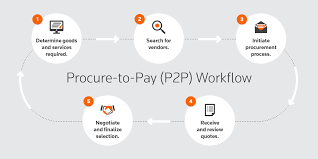

Accounts payable business process outsourcing refers to the delegation of AP tasks — such as invoice processing, vendor payments, reconciliation, and reporting — to a third-party provider. These providers specialize in finance and accounting services and often combine skilled labor with advanced automation tools to deliver streamlined, cost-effective solutions.

Outsourced AP services may include:

-

Invoice capture and validation

-

Matching invoices with purchase orders (2- or 3-way matching)

-

Managing vendor queries and relationships

-

Payment scheduling and execution

-

Expense reporting and compliance

-

Month-end closing and reporting

These tasks, when handled internally, often require significant manpower, manual entry, and oversight. By outsourcing, businesses shift the operational burden while retaining control and visibility.

How Accounts Payable BPO Saves Time

1. Faster Invoice Processing

Manual AP processes are often slow and error-prone, especially when invoices arrive in multiple formats — paper, email, PDFs, or spreadsheets. With AP BPO, third-party providers use optical character recognition (OCR) and automated workflow tools to capture, process, and validate invoices quickly.

Result:

-

Reduced turnaround time

-

Quicker approvals

-

Fewer late payments and penalties

2. Streamlined Workflows

Outsourced AP teams follow standardized, optimized workflows that eliminate bottlenecks and reduce delays in invoice handling and approvals. These streamlined processes improve consistency and minimize the need for constant follow-ups between departments.

3. Round-the-Clock Processing

Many outsourcing providers operate across time zones, which allows for 24/7 invoice processing. While your local team is offline, your outsourced AP partner can continue managing invoices, processing payments, and resolving discrepancies.

This drastically shortens processing cycles and ensures suppliers are paid on time.

4. Automated Approvals and Reporting

Modern AP outsourcing solutions often integrate automation platforms that enable touchless approvals, automated notifications, and real-time dashboards — giving finance leaders quick access to AP metrics without hours of data compilation.

How Accounts Payable BPO Saves Money

1. Lower Labor Costs

One of the most direct ways accounts payable business process outsourcing reduces costs is by lowering labor expenses. Hiring, training, and retaining in-house AP staff can be expensive — especially in high-cost regions.

Outsourcing allows businesses to tap into qualified professionals in lower-cost markets without compromising quality. Providers also bear the costs of recruitment, onboarding, and HR management.

2. Reduced Error Rates and Penalties

Manual errors in invoice processing can lead to:

-

Duplicate payments

-

Missed payment deadlines

-

Vendor disputes

-

Compliance issues

These mistakes are costly and can damage supplier relationships. Outsourcing partners use robust quality control systems and audit-ready documentation to reduce error rates, ensure compliance, and avoid costly late fees or overpayments.

3. No Investment in Infrastructure or Software

With AP BPO, you don’t need to invest in expensive ERP systems, AP automation tools, or IT infrastructure. Most outsourcing providers already use state-of-the-art AP platforms, and many can integrate with your existing systems.

This eliminates the need for capital investment and reduces ongoing maintenance and upgrade costs.

4. Better Cash Flow Management

A streamlined and accurate AP process means your business can take advantage of early payment discounts, avoid late fees, and better predict outgoing cash flows. This visibility and control over payables translates to improved working capital management and healthier financials.

5. Scalable Operations Without Added Costs

As your business grows, your AP workload increases. Scaling an in-house team means hiring more staff, investing in more tools, and managing more complexity.

With accounts payable business process outsourcing, scaling is seamless. Providers can quickly allocate more resources as needed — allowing your business to grow without incurring proportional overhead costs.

Additional Strategic Benefits

Beyond time and money savings, AP BPO provides other key benefits:

✔️ Enhanced Compliance and Risk Management

Outsourcing firms follow standardized processes and maintain compliance with financial regulations, tax laws, and audit requirements — helping you mitigate risk.

✔️ Improved Vendor Relationships

Faster, more accurate payments lead to better relationships with suppliers. This can result in preferred vendor terms, loyalty, and even cost savings in the long term.

✔️ Refocused Internal Resources

When your in-house team is no longer overwhelmed with day-to-day AP tasks, they can focus on financial planning, vendor strategy, and other value-added functions.

Is Accounts Payable Outsourcing Right for Your Business?

Ask yourself:

-

Is your AP team overwhelmed with manual tasks?

-

Are you missing payment deadlines or struggling with invoice backlogs?

-

Do you want to reduce costs without cutting corners?

-

Are you looking to digitize and modernize your finance function?

If you answered yes to any of the above, accounts payable business process outsourcing could be a highly effective solution.

Getting Started: Best Practices

-

Assess Your Current AP Process: Identify inefficiencies, bottlenecks, and cost centers.

-

Define Your Outsourcing Goals: Cost reduction, process improvement, scalability, etc.

-

Choose a Trusted BPO Partner: Look for AP-specific experience, strong data security policies, and technology integration.

-

Set Clear KPIs: Monitor performance through metrics like invoice cycle time, accuracy rate, and cost per invoice.

-

Ensure a Smooth Transition: Provide process documentation, assign internal points of contact, and align workflows early.

Final Thoughts

Accounts payable business process outsourcing is no longer just a tactical cost-cutting move — it’s a strategic advantage. It enables organizations to save valuable time, lower costs, improve accuracy, and position finance teams to focus on what really matters: driving business growth.

As automation and global collaboration become the norm, outsourcing AP is quickly becoming the smartest way to modernize your finance department and scale operations efficiently.

Are you ready to transform your AP function? Outsource smart — and watch your bottom line grow.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness