How Outsourcing AR in NetSuite Reduces DSO and Boosts Liquidity

In today’s fast-paced and margin-sensitive business environment, CFOs are under growing pressure to deliver more with less. Whether it’s improving cash flow, maintaining financial transparency, or supporting aggressive growth strategies, finance leaders are expected to do it all—efficiently and at scale.

This pressure is driving a significant trend in finance transformation: more CFOs are choosing to outsource accounts receivable on NetSuite to streamline operations, reduce overhead, and improve results.

NetSuite, one of the most powerful cloud-based ERP systems, is already a favorite among mid-sized and enterprise-level businesses. But when combined with outsourced AR services, its full potential is unleashed—bringing automation, insight, and cash flow efficiency to the forefront of your finance strategy.

Let’s explore why CFOs are making this strategic move and how it’s paying off.

Why Accounts Receivable Is a Strategic Priority

Accounts receivable (AR) is often seen as a back-office function, but it has a direct impact on:

-

Cash flow and liquidity

-

Customer relationships

-

Working capital management

-

Business continuity and resilience

Despite its importance, AR is typically plagued by manual workflows, staffing challenges, and inconsistent follow-ups. In a growing company, these inefficiencies can lead to rising Days Sales Outstanding (DSO), delayed payments, and unpredictable cash flow.

Enter NetSuite—with its powerful automation tools, built-in dashboards, and integrated financial reporting. But while NetSuite provides the digital foundation, it still requires people and processes to make AR truly effective.

That’s why CFOs are now choosing to outsource accounts receivable on NetSuite—combining ERP capabilities with skilled external teams who specialize in collections, invoicing, and customer communication.

What Does It Mean to Outsource Accounts Receivable on NetSuite?

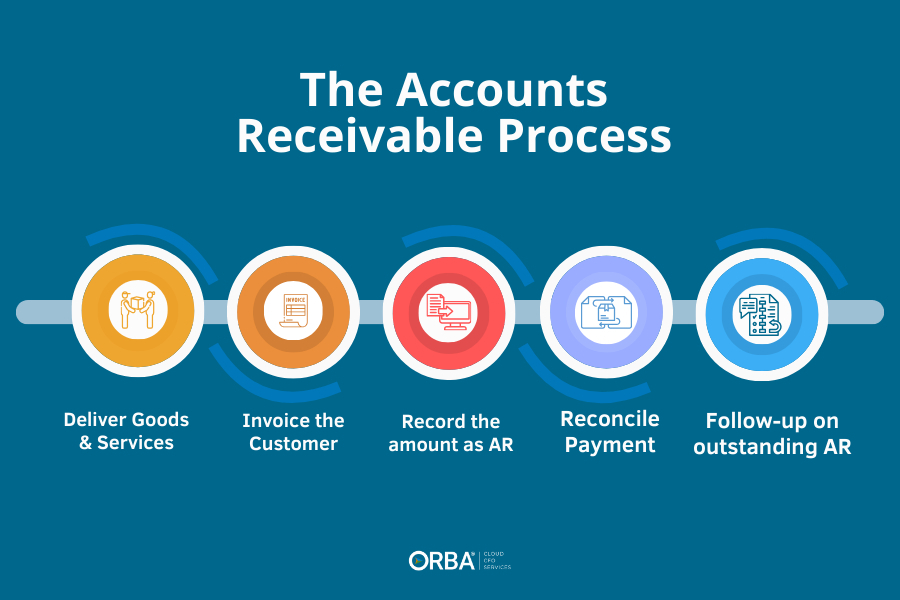

To outsource accounts receivable on NetSuite means partnering with a third-party provider who manages your AR function end-to-end, directly within or integrated with your NetSuite environment. Their responsibilities typically include:

-

Generating and sending invoices through NetSuite

-

Monitoring aging reports and following up on overdue accounts

-

Applying payments and resolving disputes

-

Communicating with customers professionally

-

Reporting on cash flow and collection performance

-

Ensuring AR compliance and audit readiness

These providers use your existing NetSuite system—meaning you retain full visibility and control, while offloading the manual, time-consuming aspects of AR.

Why CFOs Are Outsourcing AR in NetSuite: Key Drivers

1. Faster Collections and Improved Cash Flow

Cash is king, especially in uncertain economic times. AR outsourcing teams bring discipline and consistency to your collection process. When combined with NetSuite automation, they help reduce DSO and accelerate cash inflows.

CFOs appreciate how this directly supports strategic goals such as expansion, hiring, or capital investment.

💡 Companies that outsource AR on NetSuite have reported up to a 30% improvement in cash flow within the first six months.

2. Reduced Operational Costs

Building and maintaining a skilled AR team is expensive. Salaries, benefits, training, and technology add up quickly—especially in competitive markets.

When you outsource accounts receivable on NetSuite, you access trained professionals at a fraction of the cost, with no HR burden. Plus, your outsourced team scales with you—without the overhead of recruiting or restructuring.

3. Better Use of NetSuite’s Capabilities

Many companies underutilize their NetSuite instance—especially when it comes to AR automation. An experienced outsourcing partner knows how to get the most from NetSuite’s built-in tools, including:

-

Automated billing schedules

-

Payment reminders and alerts

-

Real-time dashboards and KPIs

-

Multi-entity and multi-currency support

-

Workflow and approval automation

With the right partner, your NetSuite system becomes a centralized AR command center—streamlined, accurate, and insight-driven.

4. Improved Reporting and Forecasting

Outsourced AR teams bring financial discipline and real-time data into your receivables process. They create consistent reporting, accurate reconciliation, and clean audit trails—all within your NetSuite dashboards.

This gives CFOs better visibility into:

-

Outstanding balances

-

Customer payment behavior

-

Cash flow projections

-

High-risk accounts

These insights drive smarter decision-making and more accurate forecasts—key components of any strategic finance role.

5. Focus on Strategic Finance, Not Collections

CFOs are expected to play a more strategic role—partnering with the CEO, supporting investor relations, and driving digital transformation.

But too often, finance leaders get pulled into operational issues like late payments or invoice disputes. By outsourcing AR in NetSuite, CFOs and their teams can reclaim valuable time to focus on business growth and long-term planning.

6. Enhanced Customer Experience

AR isn’t just about getting paid—it’s about maintaining healthy relationships. A professional outsourced AR team handles collections with courtesy, empathy, and consistency.

With clear communication, timely invoicing, and easy payment options, customers are less likely to delay payments or escalate disputes. This protects your brand reputation while improving retention.

Real-World Example

Imagine a mid-sized tech company using NetSuite. The business has grown rapidly, but the finance team is overwhelmed. Invoices go out late, customers don’t respond to reminders, and collections are inconsistent.

After choosing to outsource accounts receivable on NetSuite, the company sees immediate results:

-

Invoices are automatically generated and sent within NetSuite

-

Follow-ups are consistent and professional

-

DSO drops from 60 to 38 days in 4 months

-

Finance team shifts focus to cash forecasting and investor reporting

-

Customers appreciate the improved billing communication

This is a perfect example of how AR outsourcing isn’t just about cutting costs—it’s about unlocking strategic value.

How to Choose the Right AR Outsourcing Partner for NetSuite

Not all AR outsourcing firms are built the same. Here’s what CFOs should look for:

-

Proven experience with NetSuite integration

-

Familiarity with your industry’s billing complexities

-

Strong data security and compliance practices

-

Transparent communication and SLAs

-

Customizable workflows and scalable support

-

Real-time access to reports and KPIs within NetSuite

Make sure your partner can function as an extension of your team, not just a vendor.

Final Thoughts

For modern CFOs, efficiency, agility, and strategic thinking are non-negotiable. By choosing to outsource accounts receivable on NetSuite, finance leaders are eliminating operational friction, improving collections, and building more resilient finance departments.

It’s not just about reducing workload—it’s about elevating the role of finance within the organization.

If you're a CFO looking to optimize cash flow, improve reporting, and unlock the full potential of NetSuite, AR outsourcing might just be the most strategic move you make this year.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness