Third Party Risk Management Market: Growth, Trends, and Future Outlook

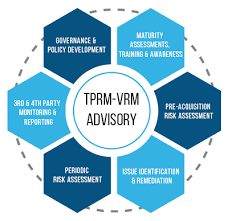

The global business landscape is experiencing significant transformation as organizations increasingly depend on external vendors, suppliers, and service providers for critical operations. The Third Party Risk Management Market Size continues expanding as enterprises recognize the critical importance of managing vendor-related risks comprehensively. The Third Party Risk Management Market size is projected to grow USD 10.49 Billion by 2035, exhibiting a CAGR of 6.21% during the forecast period 2025-2035. This substantial growth reflects increasing regulatory requirements and expanding third-party ecosystems across industries globally. Organizations are investing heavily in comprehensive risk management platforms to protect against vendor-related vulnerabilities effectively. Supply chain disruptions and cybersecurity incidents involving third parties have highlighted urgent need for robust management frameworks. The proliferation of cloud services and outsourcing arrangements creates expanding attack surfaces requiring sophisticated risk assessment capabilities.

Financial institutions represent major contributors to market expansion as banks and insurance companies face stringent regulatory requirements for vendor oversight. Healthcare organizations are adopting third-party risk management solutions to protect patient data shared with external service providers. Retail enterprises deploy comprehensive vendor management systems ensuring supply chain integrity and compliance maintenance. Manufacturing facilities utilize risk management platforms monitoring supplier performance and identifying potential operational disruptions. Technology companies invest substantially in third-party risk solutions protecting intellectual property and customer data effectively.

Regulatory compliance requirements have become primary drivers as governments worldwide mandate enhanced vendor oversight and due diligence. Financial services regulations including OCC guidance and FFIEC requirements mandate comprehensive third-party risk programs. Data protection regulations including GDPR and CCPA require organizations to ensure vendor compliance with privacy standards. Healthcare regulations mandate business associate agreements and ongoing vendor security assessments. Critical infrastructure protection requirements necessitate enhanced scrutiny of vendors accessing sensitive systems.

Technological advancements are revolutionizing third-party risk management through automation, artificial intelligence, and continuous monitoring capabilities. Automated assessment workflows reduce manual effort while improving consistency and coverage across vendor populations. Artificial intelligence enables predictive risk scoring identifying potential vendor issues before they materialize into incidents. Continuous monitoring platforms provide real-time visibility into vendor security postures and compliance status. Integration capabilities connect risk management platforms with procurement, legal, and security systems creating unified views.

Top Trending Reports -

social mapping management Market Segmentation

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness